The Cap Table Model Template for Start-up Founders

A capitalization table, also known as a cap table, provides a clear and concise overview of the ownership structure of a company.

What is a cap table?

A capitalization table, also known as a cap table, provides a clear and concise overview of the ownership structure of a company. It serves as a snapshot in time that displays the distribution of equity among shareholders, including the details of all securities such as common shares, preference shares, convertible notes, SAFEs, warrants, and employee options.

The cap table acts as a ledger for companies to keep track of the shareholder equity component of their balance sheet. As a new business owner, creating a cap table should be one of the initial steps you take when starting your venture. This document is crucial in the process of securing financing, as it effectively demonstrates the ownership stakes and control within the company, which is particularly important for early-stage startups.

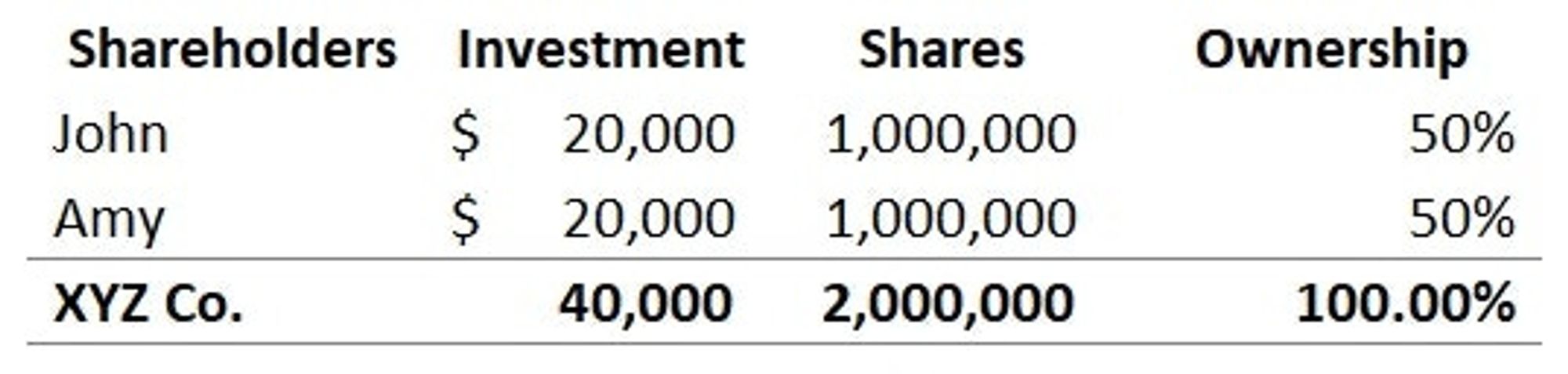

The equity percentage can be calculated based on the number of shares and shares outstanding. Let's say John and Amy decided to invest a total of USD 40,000 to start XYZ Co. and issued 1,000,000 shares each, John and Amy then own 50% of XYZ Co. each, assuming they split the investment evenly :

As the company grows and becomes more complex, with multiple founders or investment rounds, the cap table will play a crucial role in monitoring the changes in share distribution over time.

There may be times when the company may also issue various types of equity such as preferred shares or convertible debt, and the cap table should be able to accurately keep track of these developments. For the purpose of this template and post, we’ll be simplifying the type of shares but still include a convertible note mechanism as it is commonly used in startups.

Why model a cap table?

Capitalization table modeling can be a valuable tool when anticipating future share issuances, also known as capitalization events. In these situations, modeling your cap table can provide several benefits, including:

-

Planning for funding rounds by determining the amount of equity that can be sold and the potential dilution of your ownership stake.

-

Evaluating and comparing different funding offers.

-

Understanding the effects of convertible notes on dilution and share price.

-

Monitoring and managing the employee option pool levels to effectively plan allocations.

-

Visualizing various exit scenarios and determining the distribution of proceeds to maximize shareholder returns when planning the sale of your company.

My cap table model template

Here are the capabilities of my template:

-

Calculate equity reallocation across five rounds of funding, and see the final dilution across each shareholder.

-

Determine the estimates for Convertible Notes and Priced Rounds.

-

Calculate the estimated price per share and post-money valuations.

-

Analyze exit scenarios to determine the payout for each founder and angel investor or venture capital round.

Thanks for reading, feel free to reach out and bounce ideas with me!